Return on Investment (ROI) Calculator

ROI Defined

At its core, ROI is a simple yet potent equation. It quantifies the efficiency of an investment by relating the benefit gained to the resource expended. In simpler terms, it tells you how much of every dollar invested translates into actual profit. The formula speaks for itself:

ROI = (Net Profit / Investment Cost) × 100%

A higher ROI signifies a more efficient investment, where each dollar sown yields a bountiful harvest of profit. Conversely, a low ROI raises red flags, prompting a closer look at the reasons behind the meager return.

Example Calculation of ROI

Let's consider a practical example: if an investment of $10,000 yields a net profit of $2,000, the ROI would be calculated as follows:

ROI = ((2,000−10,000) / 10,000) × 100 = −80%

In this instance, a negative ROI indicates a loss on the investment.

Interpreting ROI

But understanding ROI goes beyond simply comparing numbers. Recognizing industry benchmarks and analyzing your own ROI trend over time are crucial for insightful interpretations. For instance, a 15% ROI might be excellent for a retail store but underwhelming for a tech startup. Similarly, a declining ROI within your own business demands immediate attention to identify and rectify the underlying issues.

Strategies for Improving ROI

Don't settle for a stagnant ROI! Proactive strategies can turn the tide, propelling your return on investment toward new heights:

- Rev Up Revenue: Increase sales volume through marketing initiatives, product expansions, or exploring new markets.

- Trim the Fat: Analyze and optimize your cost structure, eliminating unnecessary expenses and streamlining operations.

- Optimize Pricing: Implement dynamic pricing strategies or negotiate better deals with suppliers to improve margins.

- Enhance Efficiency: Leverage technology and training to increase operational efficiency and reduce waste.

Return on Investment (ROI) is a potent tool that empowers businesses and investors to gauge the success of their financial endeavors. By understanding and harnessing the power of ROI, stakeholders can make informed decisions, optimize their investment strategies, and ultimately achieve their financial objectives.

Comments on the calculator

Return on sales (ROS) calculator that helps businesses track their profitability and make informed decisions about their pricing strategies.

Go to calculation

The VAT (Value Added Tax) Calculator performs the calculation for extracting or charging Value Added Tax at a given rate.

Go to calculation

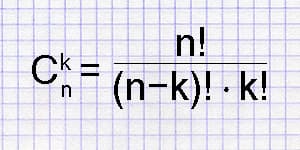

The combinations calculator helps you determine the count of potential combinations from a specified number of objects, denoted as "n choose k."

Go to calculation